Leon Neal

Thesis

European Oil & Gas companies are trading at incredibly attractive valuations — even if investors adjust the companies’ profitability according to a falling oil and energy prices.

One name that I particularly like is BP (NYSE:BP), as I believe the company has found a sensible balance between harvesting its legacy oil and gas business, while investing in new renewable energy sources.

Against the backdrop of high energy prices, BP strongly outperformed the market. BP shares are up by more than 8% YTD versus a loss of almost 15% for the SPX. Will the outperformance continue? Hard to say. But based on a fundamental analysis, BP stock is still cheap — especially when compared to US peers. Based on a residual earnings valuation model, I calculate almost 80% upside.

Seeking Alpha

About BP

Beyond Petroleum, formerly known as British Petroleum, is an integrated energy business with headquarters in the United Kingdom. BP has been an industry leader in oil & gas since more than 110 years and today the company produces close to 2 million barrels of oil equivalent today. As of 2022, BP claims proved hydrocarbon reserves equal to 16,954 mmboe and 4.4 GW of capacity from developed renewables.

The group operates three key segments: (1) Production & operations, (2) Customers & products and (3) Gas & low carbon energy. BP’s production and operations segment. The production & operation business is focused on fossil fuel exploration and extraction (upstream). The customers & products business is the business’ marketing segment (downstream), focused on delivering solutions connected to gasoline, EV-charging, but also refining and trading. Finally, the group’s low carbon energy solutions focus on the development of decarbonization technologies and, according to the company: ‘potential moves into new value chains such as hydrogen and carbon capture and storage’.

Notably, BP has been one of the first oil and gas companies to aggressively push towards net-zero and invest in sustainable energy sources. In 2020, the group made headlines publishing: Peak oil demand and long-run oil prices:

The prospect of peak oil demand, combined with increasing plentiful supplies of oil, has led many commentators to conclude that oil prices are likely to decline inextricably over time. If the demand for oil is drying up and the world is awash with oil, why should oil prices be significantly higher than the cost of extracting the marginal barrel?

Extremely Bullish Fundamentals

Two years after BP’s ‘Peak Oil’ paper, energy prices have skyrocketed and culminated in an energy crisis. Accordingly, BP’s profits shot through the roof.

For the trailing twelve months, BP generated revenues of $201 billion, which is almost double the revenues of 2020 ($105 billion). Respectively, operating income increased from a loss of $22.1 billion in 2020 to a profit of $26.2 billion for TTM. Cash provided by operations surged to $31.2 billion.

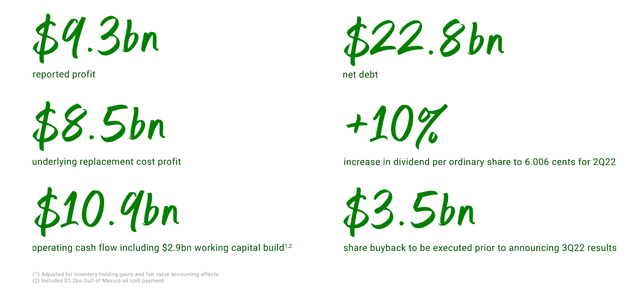

On August 2nd, BP published results for the June 2022 quarter and delivered blowout results: The group reported profits for the quarter of $9.3 billion. Operating cash flow was $10.9 billion. BP’s strong performance was driven by oil production (upstream) and refining.

On the backdrop of such an outstanding quarter, BP raised its quarterly dividend by 10% to 6,006 cents per ordinary share and said:

This increase reflects the underlying performance and cash generation of the business, which has enabled strong progress in delivering share buybacks and net debt reduction.

The company executed share buybacks of $2.3 billion during the quarter.

BP Q2 Results

Cheap Valued

Personally, I see downside for energy prices and $60/barrel could be likely by year-end. But I still believe BP is cheaply valued. Investors should consider that at $60/barrel, BP generates enough cash flow to support the current dividend payout and increase by 4% annually.

Looking ahead, on average, based on BP’s current forecasts, bp continues to expect to have capacity for an annual increase in the dividend per ordinary share of around 4% through 2025 at around $60 per barrel Brent and subject to the board’s discretion each quarter.

At $40/barrel, BP would operate cash neutral. According to the company:

It is underpinned by an average 2021-5 cash balance point of around $40 per barrel Brent, $11 per barrel RMM and $3 per mmBtu Henry Hub (all 2020 real).

Investors should consider BP’s multiple valuation versus US peers. For reference, BP trades at a one-year forward P/E of x3.5, an EV/Revenue of x0.54 and a P/B of approximately x1. XOM trades at a one-year forward P/E of about x7, an EV/Revenue of x0.95 and a P/B of approximately x2. Similarly, Chevron (CVX), currently trades at a non-GAAP P/E of about x14. This is a premium of about 100%, despite the fact that European and US oil producers equally share in profit windfalls/contractions driven by oil price volatility.

Residual Earnings Valuation

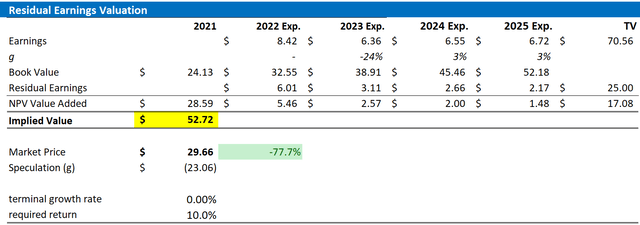

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the FTSE 100 to find the stock’s beta. For the risk-free rate, I used the US 10-year treasury yield as of August 02, 2022. My calculation indicates a fair required return of 9%.

- To derive BP’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 0 percentage points to reflect the balance of a secular decline for oil and gas business and the transition towards green energy.

Based on the above assumptions, my calculation returns a base-case target price for BP of $52.72/share, implying material upside of almost 80%.

analyst consensus; author’s calculation

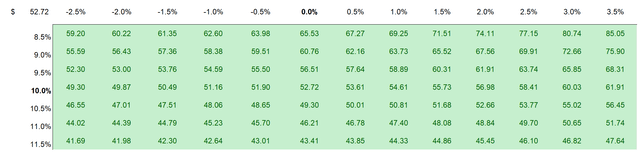

I understand that investors might have different assumptions with regards to BP’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

analyst consensus; author’s calculation

Risks To My Thesis

My thesis is connected to the implication that there are no structural differences between European and US oil majors. This, however, is not necessarily true since the respective regulatory exposure is somewhat different. Arguably, the European Union is slightly more aggressive with regards to the green energy push and US stocks generally trade at a premium. Nevertheless, a 100% relative valuation discrepancy is not justified, in my opinion. In addition, investors should note that I assume a sustainable oil price of about $60/barrel. While this might seem bearish for some readers, others might argue that the fair value for oil is much lower. As the 2020 COVID-19 induced sell-off has shown, oil can even trade at negative price-levels. If oil would break significantly below $60/share and does not recover within a sensible time-period, the bull thesis for BP would break.

Conclusion

Although I acknowledge that the oil-price risk is skewed to the downside, BP trades too cheap to ignore. Notably, investors may enjoy a 70% – 100% premium to US peers. Is this justified? I don’t think so. I value BP based on a residual earnings framework, anchored on analyst EPS consensus, and see almost 80% upside. My target price is $52.72/share.

My articles about other European Oil Majors:

- TotalEnergies: Totally Undervalued As Compared To US Peers

- Equinor: Fundamentals And Relative Valuation Indicate Significant Upside